A strategic analysis reveals that Pakistan’s external debt profile, significantly weighted towards multilateral and bilateral creditors, currently stands at approximately $92 billion. Consequently, emerging shifts in global currency dynamics, particularly the weakening US dollar, introduce a calibrated risk, potentially increasing Pakistan’s debt liabilities in rupee terms. This structural vulnerability necessitates precise economic forecasting to mitigate pressure on the nation’s debt-to-GDP ratio and maintain fiscal equilibrium.

Understanding Pakistan’s External Debt Dynamics

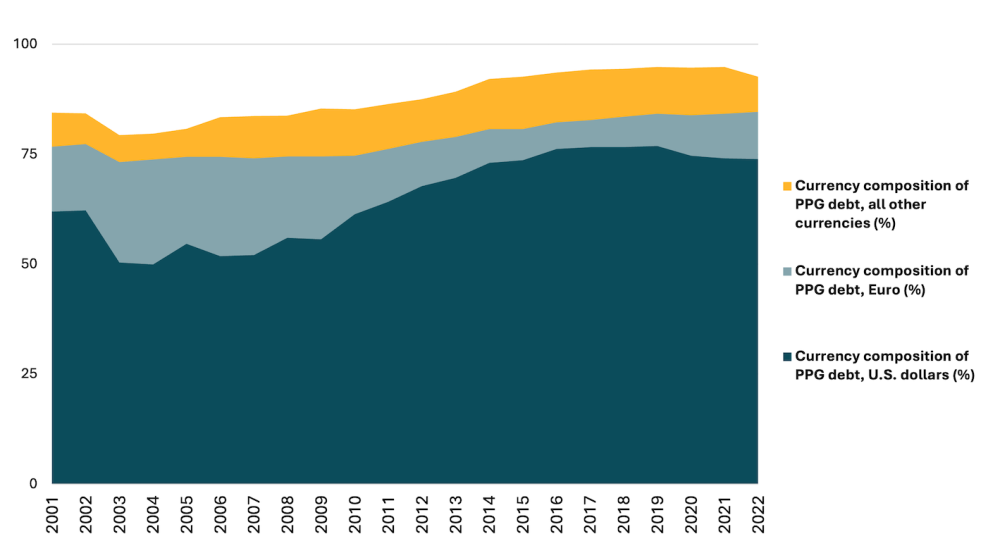

Pakistan’s external debt framework is predominantly supported by multilateral and bilateral partners, constituting about 56 percent of its total obligations. Historically, a robust US dollar often amplified these liabilities when converted to local currency. However, the recent softening of the dollar against other major global currencies signals a new phase, demanding a re-evaluation of national financial strategies.

The Calibrated Impact of US Dollar Weakness

Economists project that sustained US dollar depreciation could elevate Pakistan’s external debt burden when measured in rupees. This phenomenon directly impacts the nation’s debt-to-GDP ratio, a critical indicator of economic health. The Ministry of Finance’s Debt Policy Statement confirms that by June 2025, external debt increased by 6 percent year-on-year, reaching $91.8 billion. This reflects a structural increment of approximately $5 billion, primarily from multilateral development partners, including the International Monetary Fund.

The Translation: Deconstructing Debt Metrics for National Clarity

The technical term “multilateral and bilateral creditors” refers to institutional lenders like the IMF, World Bank, and individual countries. These entities provide significant financial support, but their loans are often denominated in foreign currencies. Therefore, when the US dollar weakens, the rupee equivalent of these fixed dollar-denominated debts increases. This means Pakistan effectively owes more rupees to repay the same dollar amount, intensifying the national fiscal challenge.

The Socio-Economic Impact: Daily Life Under Shifting Debt Loads

This macro-economic shift has direct implications for every Pakistani citizen. An increased debt burden in rupee terms can necessitate more government revenue for debt servicing. Consequently, this might reduce public sector investment in vital areas such as education, healthcare, and infrastructure. Furthermore, it could contribute to inflationary pressures, making imported goods more expensive and impacting household budgets across urban and rural Pakistan. Students and professionals could face fewer opportunities if fiscal space shrinks.

The Forward Path: Strategic Navigation Amidst Financial Currents

This current scenario represents a Stabilization Move rather than a “Momentum Shift.” While the weakening dollar presents a specific fiscal challenge, it also compels Pakistan to calibrate its debt management strategies with greater precision. Future borrowing patterns, global financial conditions, and domestic policy responses will critically influence Pakistan’s external debt outlook. Strategic economic planning is paramount to convert these challenges into opportunities for long-term fiscal resilience.