Pakistan is poised for significant economic advancement, with the State Bank of Pakistan (SBP) projecting robust Pakistan GDP Growth in the range of 3.75 – 4.75 percent for the current fiscal year (FY26). This calibrated forecast, detailed in the bi-annual Monetary Policy Report, indicates an even greater expansion for FY27. Furthermore, this positive trajectory positions Pakistan’s economy more resiliently against global economic volatilities, bolstered by strategically built fiscal and external buffers over recent years.

The Translation: Calibrating Economic Resurgence

The SBP’s report underscores a tangible uplift in economic activity. Real Pakistan GDP Growth strengthened notably to 3.7 percent in Q1-FY26, a significant increase from the modest 1.6 percent observed in Q1-FY25. This structural improvement stems from revitalized industrial and agricultural sectors. Both have experienced a notable rebound, primarily due to a stable cost of production, favorable supply-side dynamics, and eased financial conditions. Consequently, the resilience within the agricultural sector remained robust, even amidst localized flood disruptions.

Large-scale manufacturing (LSM) has also posted a broad-based recovery throughout FY26, a strategic reversal from its contraction last year. Specific sectors demonstrating strong production include automobiles, coke and petroleum products, high-value added (HVA) textiles in wearing apparel, and construction-allied industries. This precise data confirms strengthening demand and the alleviation of supply-side constraints. Moreover, it reflects improving business confidence, contained inflationary pressures, and increased imports of crucial intermediate and capital goods, all collectively supporting heightened production activity.

The Socio-Economic Impact: Amplifying Citizen Prosperity

These macroeconomic shifts directly translate into improved daily life for Pakistani citizens. For urban professionals, the broad-based recovery in LSM, particularly in construction-allied industries and high-value textiles, signals increased employment opportunities and greater job security. Consequently, this leads to enhanced household incomes and purchasing power. Furthermore, students entering the workforce can anticipate a more dynamic job market, especially in manufacturing and tech-adjacent sectors that benefit from increased capital goods imports.

In rural Pakistan, the resilient recovery in agriculture, despite earlier flood challenges, ensures stable food supplies and supports the livelihoods of farming communities. This stability is critical for preventing rural poverty and maintaining equitable economic distribution. Therefore, the strategic reduction in the Cash Reserve Requirement to 5 percent facilitates easier access to credit for small and medium enterprises (SMEs), acting as a catalyst for local business expansion and job creation across both urban and rural landscapes.

The Forward Path: A Momentum Shift for Pakistan GDP Growth

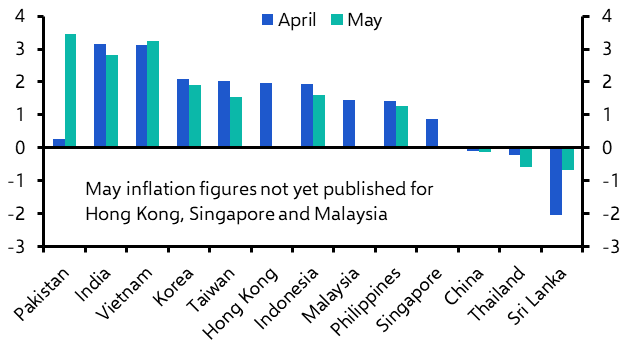

This development represents a clear Momentum Shift for Pakistan’s economy. The coordinated monetary and fiscal policies have demonstrably fostered a sustainable pickup in economic growth, crucially, without generating undue inflationary pressures or straining the external account. Inflation is projected to remain within the 5 – 7 percent target range during most of FY26 and FY27, despite some near-term volatility, providing a stable baseline for future planning.

However, sustaining this momentum necessitates a disciplined focus on productivity-enhancing structural reforms. Strategic initiatives to boost exports and privatize loss-making state-owned enterprises (SOEs) are not merely suggestions; they are critical pathways to unlock higher, more sustainable growth. While risks from global tariffs and commodity price volatility persist, domestic challenges like below-target revenue collection and climate events demand proactive solutions. Accelerating these reforms will structurally enhance the economy’s resilience against future shocks.