Pakistan Explores USD1 Stablecoin for Cross-Border Payments

Pakistan is making a significant move to reshape its digital finance landscape. The nation has officially agreed to explore using the USD1 stablecoin to facilitate Pakistan stablecoin payments across borders. This crucial collaboration involves the Ministry of Finance and SC Financial Technologies LLC, an affiliate of World Liberty Financial. Consequently, Pakistan demonstrates a proactive approach to embracing innovative digital payment systems and aims to be a key player in the evolving global financial ecosystem.

This Memorandum of Understanding (MoU) establishes robust dialogue and fosters technical cooperation. Its primary objectives include building a secure, compliant, and transparent digital payment infrastructure. Furthermore, it explores advancements in cross-border settlement and foreign exchange mechanisms. Ultimately, this initiative seeks to streamline international transactions, enhance efficiency, and potentially reduce costs associated with traditional payment corridors.

Understanding USD1 Stablecoin for Efficient Transfers

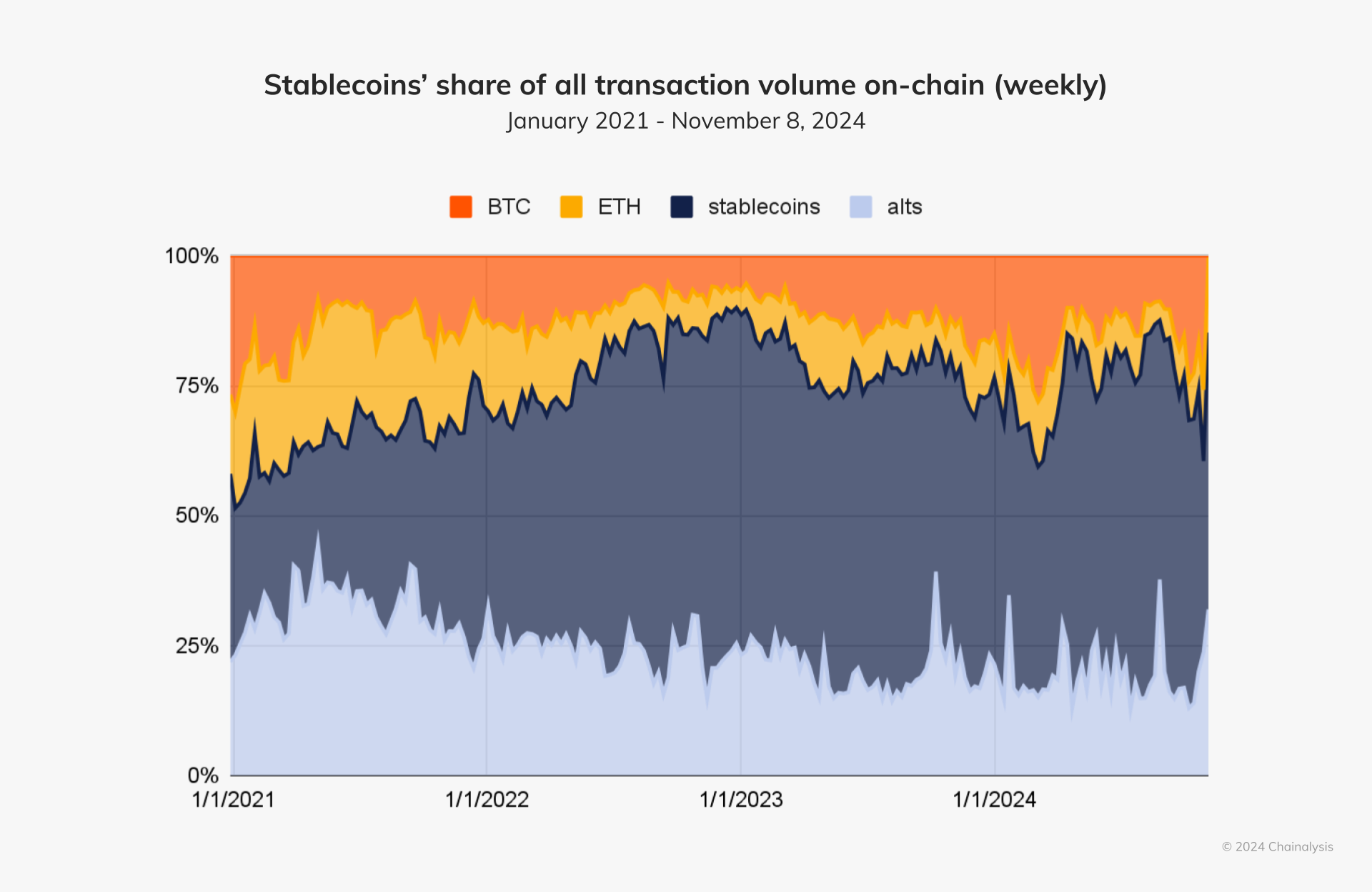

The USD1 stablecoin forms the core of this agreement. Stablecoins are cryptocurrencies designed to minimize price volatility, often by pegging their value to a stable asset. For instance, they might link to a fiat currency like the US dollar, gold, or other commodities. USD1, specifically pegged to the US dollar, combines the stability of traditional currency with the efficiency and speed of blockchain technology.

Stablecoins offer several advantages for cross-border payments. They can bypass traditional banking intermediaries, leading to faster settlement times and lower transaction fees. This is especially beneficial for countries with large diaspora populations relying on remittances. Additionally, businesses engaged in international trade will find this appealing. The inherent stability of USD1 ensures consistent value transfer, mitigating risks associated with volatile cryptocurrencies.

Pakistan’s Growing Digital Finance Footprint

This agreement represents more than an isolated event; it signifies a continuation of Pakistan’s strategic push into digital finance. The nation is increasingly recognized as a high-potential frontier market for financial innovation, driven by several key factors:

- Substantial Remittance Inflows: Annual remittances exceed USD 38 billion.

- Rapidly Expanding Digital Economy: A growing base of digital users and services.

- Significant Cryptocurrency User Base: High engagement with digital assets.

- Considerable Digital Asset Trading Volumes: Active participation in the crypto market.

Previous engagements further underscore this trajectory. In April, a Letter of Intent (LOI) between World Liberty Financial and the Pakistan Crypto Council initiated knowledge-sharing on emerging financial technologies. Furthermore, the Pakistan Virtual Asset Regulatory Authority (VARA) adopts a progressive “regulation-first” approach. It has issued No Objection Certificates (NOCs) to major platforms like Binance and HTX in record time, thereby facilitating their local incorporation. High-profile visits from industry leaders, including Binance Founder Changpeng Zhao and TRON Founder Justin Sun, highlight the burgeoning interest in Pakistan’s digital asset sector.

Economic Implications of Digital Payment Models

The exploration of USD1 stablecoin for cross-border payments carries significant economic implications for Pakistan. By adopting modern digital payment models, Pakistan aims to enhance financial inclusion and improve the ease of doing business. Moreover, this move could attract further international investment in its digital infrastructure. Facilitating quicker, more cost-effective international transactions will significantly boost trade relations and support Pakistan’s burgeoning export sector.

Senator Muhammad Aurangzeb, Federal Minister for Finance and Revenue, affirmed Pakistan’s commitment to leading financial innovation. He stated, “Pakistan recognizes that the future of finance is being shaped today. Our focus is to stay ahead of the curve by engaging with credible global players, understanding new financial models, and ensuring that innovation, where explored, is aligned with regulation, stability, and national interest.” This statement reflects a cautious yet ambitious vision for responsibly integrating cutting-edge financial technologies.

Navigating Challenges for Future Pakistan Stablecoin Payments

While the prospects are promising, integrating a stablecoin for national cross-border payments presents several challenges. These include establishing robust regulatory frameworks that balance innovation with consumer protection. Additionally, addressing potential cybersecurity risks and ensuring interoperability with existing financial systems are crucial. Furthermore, fostering widespread adoption among the populace and businesses is vital. The technical complexities of integrating blockchain solutions into a nation’s financial infrastructure also require careful planning and precise execution.

Despite these hurdles, Pakistan’s proactive engagement with global digital finance leaders and its commitment to a regulation-first strategy position it well to navigate this new terrain. This collaboration to explore USD1 stablecoin demonstrates the nation’s resolve to modernize its financial systems. Ultimately, it aims to capitalize on the immense potential of digital assets to drive economic growth and enhance its global financial standing.

Conclusion: A New Era for Pakistan’s Digital Economy

Pakistan’s agreement to explore USD1 stablecoin for cross-border payments marks a pivotal moment in its journey toward digital financial transformation. This strategic move, underpinned by a clear vision for innovation and regulatory alignment, has the potential to unlock new efficiencies. It can also reduce transaction costs and enhance the nation’s appeal as a hub for digital finance. As Pakistan continues to engage with global players and build a robust digital infrastructure, its proactive approach could serve as a model for other emerging economies. These economies might seek to harness the power of stablecoins and blockchain technology for a more interconnected and efficient global financial system.