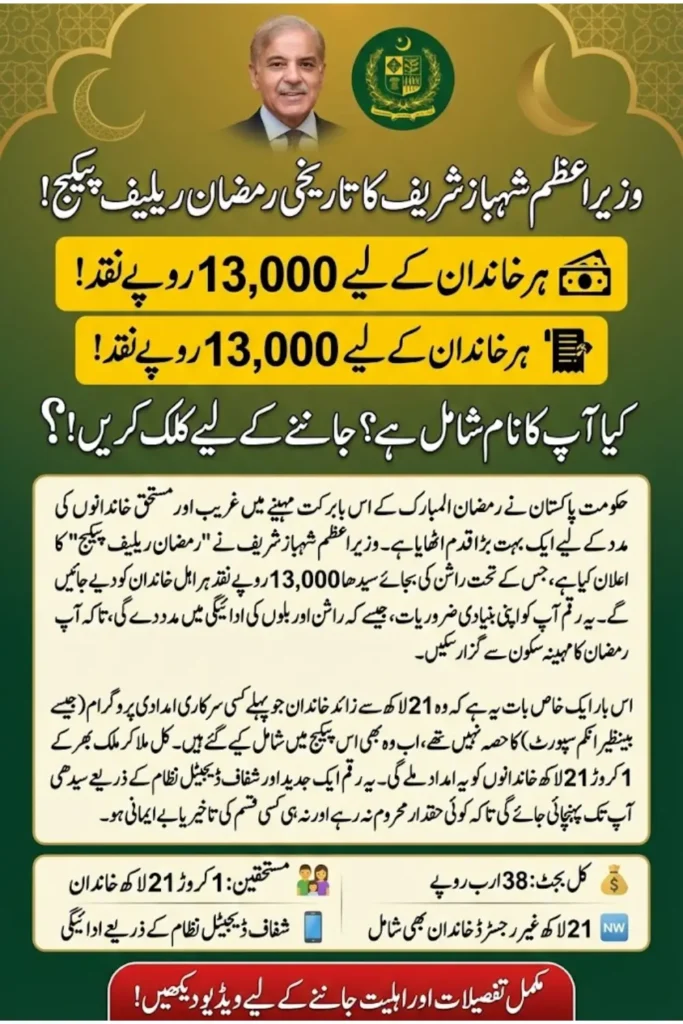

The government of Pakistan has initiated a significant Digital Cash Support program, launching the Rs. 38 billion Ramazan Relief Package to directly provide Rs. 13,000 to 1.21 million deserving families. This strategic transition towards digital disbursement seeks to elevate transparency and safeguard beneficiary dignity across all provinces, including Gilgit-Baltistan and Azad Jammu and Kashmir.

Calibrated Disbursement: Understanding the Ramazan Relief Package

Prime Minister Shehbaz Sharif precisely structured this extensive Ramazan Relief Package 2026. Consequently, funds will be distributed entirely via digital wallets or direct bank transfers, bypassing the logistical complexities of previous systems. This ensures each eligible family receives their Rs. 13,000 without encountering long queues or substandard goods, issues that previously marred relief efforts. Furthermore, a dedicated Rs. 10 billion component targets families already integrated into the government’s Kafalat program, ensuring continuity of essential aid.

Structural Impact: How Digital Cash Support Elevates Daily Life

This digitized relief mechanism fundamentally alters the daily economic landscape for Pakistani citizens. For urban professionals and rural households alike, the direct Digital Cash Support eradicates the time-consuming and often demeaning process of collecting aid. Instead, families gain immediate, dignified access to crucial funds, enabling them to procure essential goods with greater autonomy. Moreover, this system mitigates potential corruption risks, ensuring resources reach their intended recipients efficiently. The transition, however, presents challenges regarding banking access and digital literacy, particularly in remote areas.

The Forward Path: A Momentum Shift for National Advancement

The implementation of this Ramazan Relief Package through a digital framework unequivocally signifies a momentum shift for Pakistan. It represents a bold commitment to systemic efficiency and transparent governance. While coordinating with banking sectors and transitioning to a fully cashless system presents inherent operational challenges, the State Bank of Pakistan’s framework establishes a robust baseline for secure disbursement. The government’s pledge for periodic reviews further underscores a calibrated approach to national advancement. This initiative, therefore, serves as a catalyst for future digital transformations in social welfare programs.