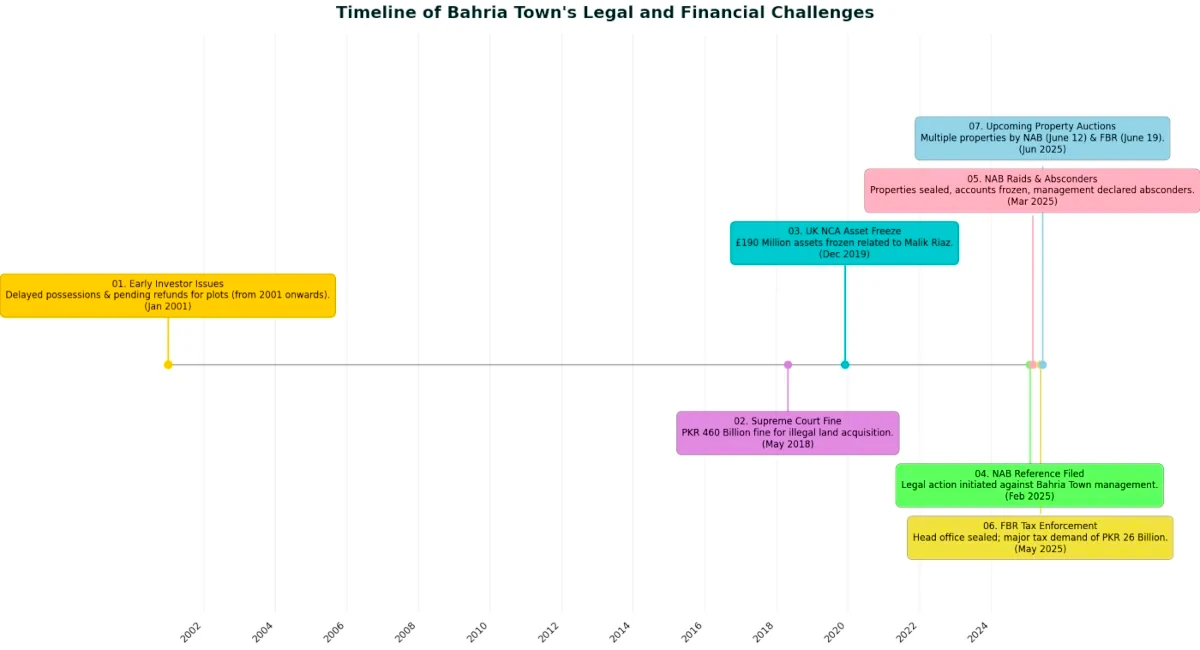

In a decisive move towards enhanced fiscal discipline, the Federal Board of Revenue (FBR) has initiated a strategic operation for FBR tax recovery, targeting Rs. 26 billion in outstanding dues from Bahria Town. This robust enforcement action underscores a national imperative to standardize financial compliance across large taxpayers. The FBR has formally issued a public notice, signaling a calibrated approach to retrieve these substantial funds, which are critical for national economic stability.

The Structural Mechanics of Enforcement

On October 7, the tax regulator executed a precision seizure of the Bahria Town Tower in Karachi. Furthermore, this operation involved comprehensive raids and the meticulous custody of all relevant financial records. The assets now under FBR’s direct control include a significant portfolio: 145 residential units, 42 offices, and 103 retail shops situated within the prominent tower. Consequently, the tax authority has strictly prohibited the sale, transfer, or disposal of these seized properties without explicit prior authorization from the FBR, establishing a robust control mechanism.

The Translation: What This Means for Fiscal Transparency

This action translates into a clear message: no entity, regardless of its scale, operates above the nation’s fiscal laws. The FBR’s move demystifies the process of tax enforcement, demonstrating that technical jargon like “outstanding dues” and “asset seizure” directly impacts national revenue collection. Essentially, it highlights the government’s unwavering commitment to ensure that all due contributions flow into the national exchequer, funding vital public services and infrastructure projects. Therefore, this proactive measure enhances systemic transparency and accountability within the economic framework.

The Socio-Economic Impact: Direct Effects on Pakistani Citizens

This enforcement action directly impacts the daily lives of Pakistani citizens by reinforcing the principle of equitable taxation. For students, professionals, and households across urban and rural Pakistan, this means a stronger likelihood of sustained public services, including education, healthcare, and infrastructure development. When large taxpayers fulfill their obligations, the fiscal burden on average citizens potentially lessens, and the capacity for the government to invest in national advancement increases. In contrast, non-compliance diverts resources that could otherwise elevate living standards and create opportunities. This robust FBR tax recovery initiative aims to stabilize and strengthen the foundational economic structures supporting every Pakistani.

The “Forward Path”: A Momentum Shift

This development definitively represents a Momentum Shift for Pakistan’s fiscal governance. The FBR is not merely reacting; it is strategically advancing the nation’s tax collection capabilities. This proactive posture sends a powerful signal to all taxpayers, fostering a culture of compliance that is critical for sustained economic growth and national progress. Furthermore, it establishes a baseline for future enforcement actions, ensuring that fiscal responsibilities are met consistently and fairly across all sectors. This systematic approach is a catalyst for a more robust and equitable financial future.

Operational Directives for Stakeholders

The FBR has clarified the protocol for any objections or claims related to the seized assets. Stakeholders must submit these to the Large Taxpayer Office (LTO) in Islamabad, strictly adhering to legal provisions. This structured process ensures due diligence and provides a clear pathway for grievance redressal within the established legal framework. Moreover, this transparency in procedure reinforces public trust in the FBR’s enforcement methodologies.

Strategic Enforcement for National Advancement

This latest action forms an integral part of the FBR’s renewed efforts to enforce compliance and recover outstanding dues from all large taxpayers. Ultimately, these measures are calibrated to enhance fiscal discipline and strengthen the nation’s economic framework. This strategic commitment to vigorous tax enforcement is a fundamental component of Pakistan’s journey towards systemic efficiency and sustainable national advancement.