The Pakistan Stock Exchange (PSX) experienced a calibrated PSX market downturn today, shedding over 2,500 points following the release of EFERT’s Q4 2025 results. With an Earnings Per Share (EPS) of Rs. 6.26 and a subdued dividend payout of Rs. 4.0 per share, these figures significantly underperformed market expectations. Consequently, this precise data point acted as a structural catalyst, initiating a decisive shift towards aggressive selling pressure primarily led by local institutional investors.

The Translation: Deconstructing the Market’s Structural Shift

This significant market movement, representing a 1.40 percent contraction, is not merely a fluctuation but a direct consequence of investor sentiment recalibrating to corporate performance metrics. EFERT’s below-par earnings report provided the specific trigger. Furthermore, the market’s immediate and acute response underscores its sensitivity to fundamental financial indicators, especially from influential entities.

Throughout the trading session, the KSE-100 index remained under relentless pressure, registering an intraday low of 4,324 points. Ultimately, it concluded the day at 180,512. This sustained decline highlights a coordinated selling strategy, with significant volumes indicating a broad-based institutional reaction rather than isolated trading.

The Socio-Economic Impact: Calibrating Citizen Financial Outlook

A pronounced PSX market downturn directly influences the financial landscape for Pakistani citizens, especially those with pension funds, mutual fund investments, or direct equity holdings. For professionals and households in urban centers, a declining market can erode savings and investment value, potentially impacting future financial planning. Conversely, this volatility can create entry points for astute long-term investors, provided they possess the strategic foresight to navigate such conditions.

This event specifically impacts market confidence. Businesses, observing a bearish trend, might delay expansion plans, thus affecting job creation. For the average Pakistani, understanding these market dynamics is crucial for making informed decisions about their economic participation and wealth management in an evolving financial ecosystem.

The “Forward Path”: A Stabilization Move Amidst Data Correction

This market adjustment, precipitated by specific corporate performance data, represents a Stabilization Move rather than a Momentum Shift. While the immediate impact is a decline, it reflects the market’s fundamental mechanism of pricing assets based on reported earnings. A robust market must accurately reflect corporate realities. Consequently, this correction, though sharp, fosters long-term health by cleansing overvalued positions and setting a more realistic baseline for future growth. The strategic imperative now involves strengthening regulatory oversight and encouraging transparent corporate reporting to build resilient investor confidence.

Market Activity: Sectoral Impact and Volume Metrics

The selling pressure was not uniformly distributed. Specifically, the Exploration & Production (E&P) sector absorbed the heaviest impact. Companies such as PPL and OGDC collectively reduced the index by 383 points, indicating a concentrated sell-off in energy-related equities. Furthermore, the combined performance of EFERT, HUBC, SYS, and BAHL further amplified the rout, contributing an additional 645 points to the index’s decline.

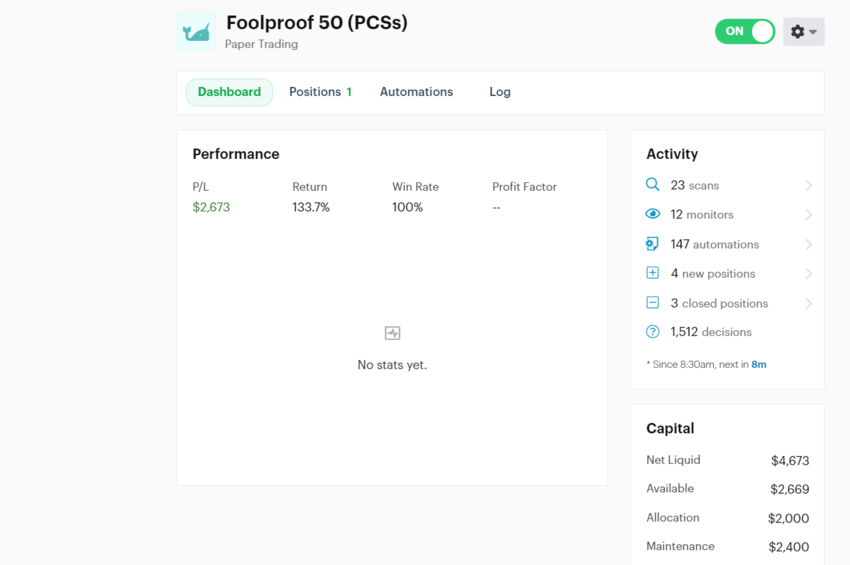

Despite the sharp decline, market activity remained robust. Total traded volumes reached 873 million shares, with a turnover clocking in at Rs. 41.7 billion. K-Electric (KEL) notably dominated the volume chart, registering 176 million shares traded. This high volume amidst a falling market indicates active participation, primarily from sellers, but also hints at buyers entering at perceived lower valuations.

Top Traded Volumes: A Snapshot of Market Participation

| SCRIP | PRICE | HIGH | LOW | CHANGE | VOLUME |

|---|---|---|---|---|---|

| KEL | 8.22 | 8.79 | 8.0 | -0.38 | 176,912,038 |

| CNERGY | 7.85 | 8.19 | 7.72 | -0.31 | 52,213,728 |

| AMTEX | 4.67 | 5.94 | 4.55 | -0.64 | 39,738,759 |

| PIBTL | 19.39 | 19.75 | 18.55 | 0.38 | 31,434,560 |

| FNEL | 1.5 | 1.59 | 1.46 | -0.06 | 30,912,538 |

| WTL | 1.65 | 1.72 | 1.63 | -0.04 | 29,825,599 |

| EPCL | 38.48 | 39.32 | 36.15 | 2.19 | 27,131,007 |