Pakistan’s economic trajectory shows promising signs of a robust Pakistan Economic Recovery, with State Bank of Pakistan (SBP) Governor Jameel Ahmed forecasting growth up to 4.75 percent for the current fiscal year. This optimistic outlook, surpassing recent International Monetary Fund (IMF) estimates, is strategically underpinned by strengthening domestic demand, resilient agricultural output, and calibrated easing of financial conditions. Consequently, the SBP has elevated its FY26 growth forecast, signaling a structural shift towards economic stability and progress.

Understanding Pakistan’s Calibrated Growth Outlook

SBP’s Strategic Forecast vs. IMF Projections

The SBP’s revised growth forecast of 3.75–4.75 percent for FY26 represents a 0.5 percentage point increase from previous projections. This adjustment directly counters the recent IMF downgrade, highlighting a divergent yet data-driven perspective on Pakistan’s financial health. Furthermore, Governor Ahmed attributes this upward revision to several key indicators. Specifically, high-frequency metrics, coupled with a notable 6 percent growth in large-scale manufacturing, underscore a significant resurgence in domestic demand. Agricultural activity, a critical sector, has also demonstrated consistent strength, effectively mitigating the residual impacts of previous year’s floods. In essence, the SBP is observing a fundamental strengthening of internal economic drivers, a baseline for sustainable expansion.

Moreover, the Governor explained that an aggregate 1,150-basis-point reduction in the policy rate since June 2024 has strategically eased financial conditions. This precise monetary intervention has acted as a catalyst, supporting overall economic growth while meticulously maintaining price and broader economic stability. Consequently, this policy move reflects a calibrated approach to stimulate the economy without compromising long-term financial health. Though exports faced headwinds from low global prices and border disruptions, strong remittance inflows are projected to keep the current account deficit within a manageable 0–1 percent of GDP, concurrently bolstering foreign exchange reserves.

Empowering Pakistan: Daily Life Implications of Economic Growth

The projected Pakistan Economic Recovery translates directly into tangible benefits for the average citizen. For students and young professionals, a growing economy implies enhanced job creation and increased opportunities across various sectors, particularly manufacturing and technology. Professionals can anticipate improved salary prospects and greater career mobility. Furthermore, stable economic conditions, driven by controlled inflation and accessible credit through eased financial policies, directly enhance household purchasing power. This leads to improved living standards for urban families and rural communities alike, who benefit from strong agricultural output and stable food prices. In essence, a robust economic outlook creates a more predictable and prosperous environment for every Pakistani.

The Forward Path: Momentum Shift or Stabilization Move?

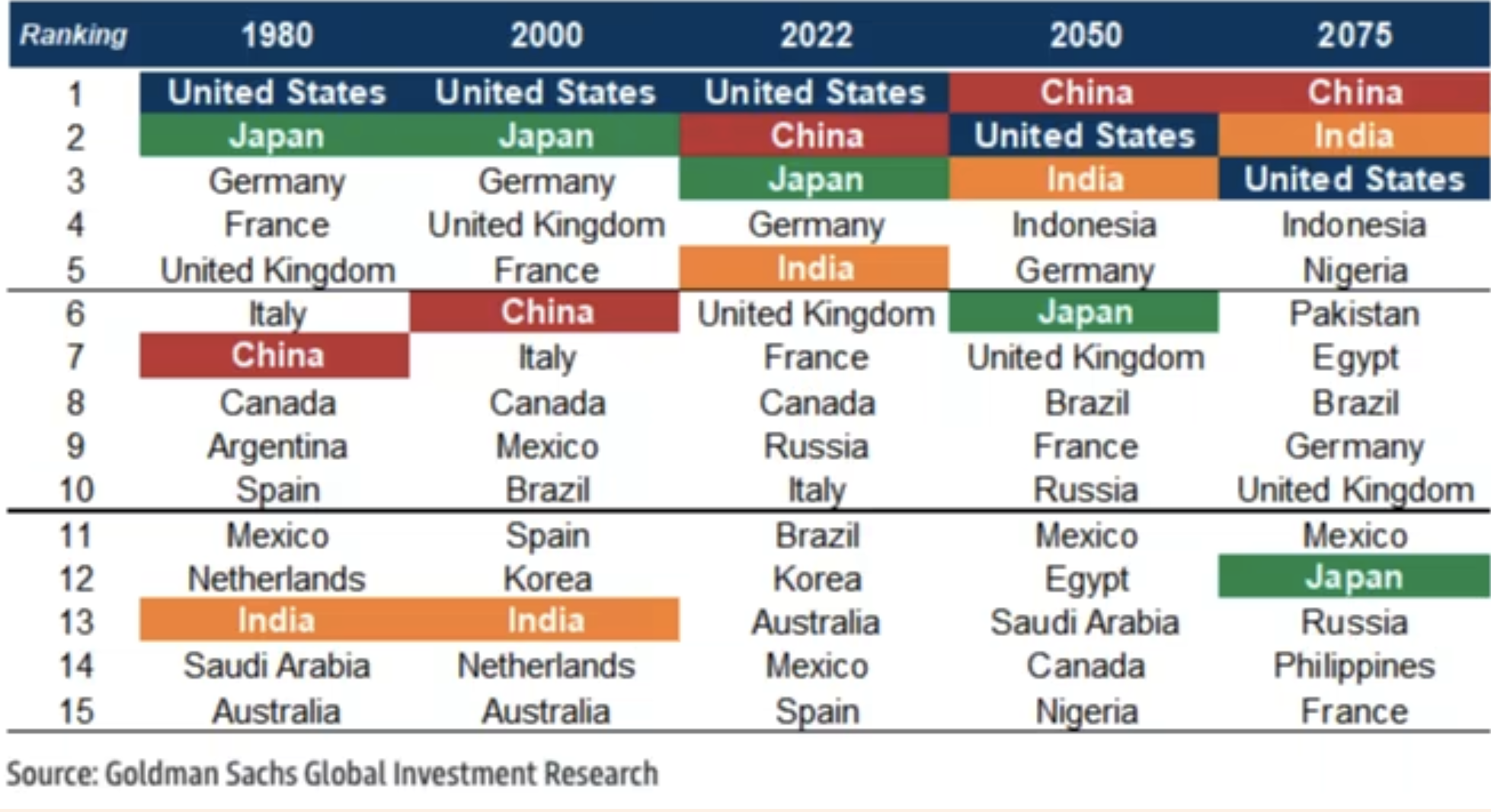

This development undeniably represents a Momentum Shift for Pakistan’s economy. The SBP’s proactive stance, coupled with evidence of strengthening domestic indicators, suggests a strategic pivot away from reactive policy-making. It indicates a structural reinforcement of internal economic mechanisms. While external factors remain dynamic, the emphasis on robust domestic demand, agricultural resilience, and calibrated monetary policy provides a strong baseline. This trajectory points towards sustained growth, positioning Pakistan for a more autonomous and accelerated advancement on the global economic stage.